Did you know that you must pay back any unallowable costs charged to your grants to the federal government?

Your grants need proper management and a solid grasp of which costs you can and cannot charge. Federal guidelines state that allowable costs for federal grants should be reasonable and necessary to finish the project. The difference between these costs isn’t always clear-cut, especially if you manage several projects with unique requirements.

Misclassifying your expenses can lead to serious problems. The Office of Management and Budget’s Uniform Guidance demands that universities and organizations spot unallowable costs. These costs must stay out of any application, proposal, billing, or claim linked to federally sponsored projects.

We know how tough it can be to handle these requirements. This detailed guide will help you understand what makes a cost allowable. You’ll learn to identify unallowable expenses and get practical tips to keep your grant spending compliant.

Your Roadmap to Grant Cost Compliance

- Understanding Allowable vs. Unallowable Costs

- Key Tests to Identify Unallowable Costs

- Common Categories of Unallowable Costs

- Expert Tips to Avoid Unallowable Charges

- Conclusion

- FAQs

1. Understanding Allowable vs. Unallowable Costs

Federal regulations draw clear lines between costs you can and cannot charge to grant funds. These differences help you stay compliant and avoid potential risks.

What makes a cost allowable under federal grants

The outlines four fundamental tests to determine if a cost is allowable. The cost must be Office of Management and Budget’s Uniform Guidance reasonable – it should not exceed what a prudent person would spend in similar circumstances. It must be allocable – directly benefiting the specific grant or assignable based on relative benefits received. Consistency demands similar costs be treated the same way across activities whatever the funding source. The expense must also conform to any limitations in grant terms or federal regulations.

The cost must be well documented and essential for grant performance. It must follow generally accepted accounting principles and cannot be used as cost-sharing for other federal programs.

Common traits of unallowable costs for federal grants

We grouped unallowable costs into these categories:

- Expenses that regulations explicitly prohibit (like alcohol or entertainment costs)

- Costs that violate your grant agreement terms

- Expenses failing the allowability tests mentioned above

- Costs “guilty by association” with unallowable activities

You’ll often see examples like advertising (except for specific program purposes), alcoholic beverages, bad debts, donations, entertainment, fundraising, lobbying, and public relations costs.

Why this difference matters for compliance

Wrong cost classifications can lead to serious problems. The federal government wants payments made for unallowable costs refunded with interest. Your organization might face negative audit findings if you fail to identify and separate unallowable costs properly.

Non-compliance damages your organization’s credibility and puts future funding at risk. Most institutions have grants accounting offices that review all expenses to ensure they meet reasonable, allocable, and allowable standards.

These differences go beyond just following rules. They protect your organization’s financial integrity and keep vital funding sources available.

2. Key Tests to Identify Unallowable Costs

You need to apply four critical tests to spot unallowable costs in your grants. These practical tests act as your first defense against compliance issues.

The Reasonable Cost Test

A prudent person test is a standard used to determine if a cost is allowable and reasonable. This test checks if the expense is something a reasonable person would incur under similar circumstances at that time. To pass, a cost must be ordinary and necessary for an organization’s operations or grant performance. The test considers several factors: the necessity of the cost for proper grant performance, its consistency with established institutional policies, and whether individuals acted with due diligence and responsibility toward the organization, the public, and the federal government.

The Allocable Cost Test

A cost becomes allocable when it is based on the benefits received by your grant. The cost meets this requirement in three ways: it’s either specifically for the federal award, helps both the award and other activities in measurable proportions, or your organization needs it to operate and can assign part of it to the award. Note that you must split costs that help multiple projects based on how much each one benefits.

The Consistency Rule

The consistency test demands uniform treatment of costs whatever the funding source. You can’t treat a cost as direct in one case and indirect in another under similar conditions. Your organization should use the same accounting methods for federal awards, non-federal activities, and its coverage periods.

Documentation and audit readiness

Good documentation protects you during audits. Each expense needs proper that proves it was needed, reasonable, allocable, and the grant agreement allowed it supporting documentation. Your accounting systems should track both allowable and unallowable costs as they come in. The core team needs budget-friendly training, and you should test your procedures regularly to ensure they work.

3. Common Categories of Unallowable Costs

Federal grants come with specific categories of expenses that you cannot claim. Understanding these common unallowable costs helps avoid compliance problems.

Entertainment and alcohol

The government does not allow costs linked to entertainment, which covers amusement, diversion, social activities and related expenses. You cannot charge alcoholic beverages to federal grants. The government might approve these costs in rare cases that serve a specific program purpose with prior written permission from the granting agency.

Lobbying and fundraising

You cannot use grant money to influence legislation at any government level. This restriction covers expenses to contact legislators, build public support for legislation, or take part in political campaigns. The government also prohibits all fundraising costs, including financial campaigns and gift solicitations.

Personal use items and memberships

Grant funds cannot pay for personal items like cars or office decorations. The rules also block payments for memberships in civic groups, community organizations, social clubs, dining clubs, or country clubs.

Fines, penalties, and bad debt

Grant money cannot cover bad debts or collection costs. The rules prevent charging fines, penalties, or settlements from breaking laws or regulations. These costs become allowable only when they directly relate to award terms.

Unapproved travel and relocation expenses

The rules do not allow first-class airfare, expensive lodging costs, and moving expenses for staff members who leave within their first year.

4. Expert Tips to Avoid Unallowable Charges

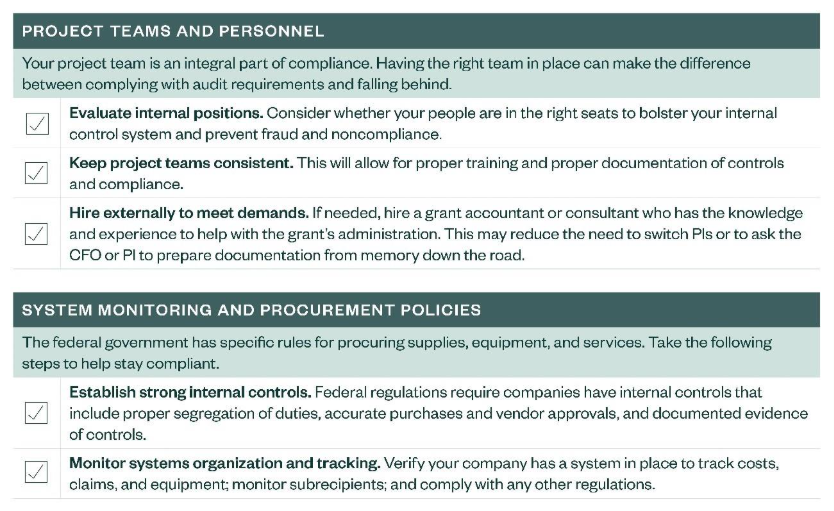

Budget compliance starts with proactive systems rather than fixing problems after they occur. Your grant management needs systematic approaches to comply with federal regulations.

Train staff on federal cost principles

is an allowable expense under federal grants that many organizations overlook Staff training. Put your resources into teaching your team about cost principles, especially when you have people handling financial transactions. This investment helps you stay compliant and reduce risks. A regular training schedule keeps your staff up to date with changing regulations.

Use clear internal policies and account codes

Create detailed that spell out allowable and unallowable costs written policies. Your accounting systems should track and separate expenses as they come in. Account codes help you keep different funding sources separate. These systems make sure you treat similar expenses the same way across all funding sources.

Review award terms and conditions carefully

Each grant has its own requirements that override general guidelines. Take time to get into all award documents since there might be specific limits beyond standard regulations. Special provisions deserve extra attention because they matter more than general cost principles.

Conduct regular internal audits

Test your procedures through from time to time internal reviews. Monthly or quarterly checks help you spot issues early. These reviews prepare you for external audits and let you fix small errors right away.

Ask your grants office when in doubt

Reach out to your grants management specialist with big questions or possible errors. Guidelines exist but different agencies interpret them differently. Getting clarity early saves time and prevents headaches down the road.

5. Conclusion

Success depends on how well you handle unallowable costs. This piece has helped you learn about the key differences between allowable and unallowable expenses. You now understand the four main tests to evaluate costs and know which charges are typically prohibited.

Federal grant compliance can feel daunting at first. Notwithstanding that, your organization can direct these requirements with confidence once you have the right systems and knowledge. Your best defense against compliance issues and penalties lies in detailed documentation, proper training for the core team, and well-defined internal policies.

Catching unallowable costs early beats fixing them later. Your organization needs regular internal audits and ongoing staff education to spot issues before they turn into serious compliance problems. It also helps to check with your grants office whenever questions come up – this shows your steadfast dedication to proper fund management.

Mishandling grant funds can do more damage than just financial penalties. Your future funding opportunities and the organization’s reputation rely on how responsibly you manage grants. Time and resources invested in compliance systems today will secure your access to crucial funding sources tomorrow.

This guide gives you practical tools to identify and handle unallowable costs in your grants. These insights and strategies let you worry less about compliance and focus more on the work your grants support.

6. FAQs

Q1. What are considered unallowable costs in grant management? Unallowable costs typically include entertainment expenses, alcoholic beverages, lobbying activities, fundraising costs, personal use items, fines, penalties, bad debts, and unapproved travel or relocation expenses. These costs cannot be charged to federal grants and must be excluded from any claims or proposals.

Q2. How can I determine if a cost is allowable for a grant? To determine if a cost is allowable, apply four key tests: Is it reasonable? Is it allocable to the grant? Is it treated consistently across all activities? Does it conform to grant terms and federal regulations? Additionally, the cost must be necessary for grant performance and adequately documented.

Q3. What are some common categories of expressly unallowable costs? Expressly unallowable costs are those explicitly prohibited by federal regulations. Common examples include entertainment costs, alcoholic beverages, advertising (except for specific program purposes), donations, general public relations costs, and lobbying expenses.

Q4. How can organizations avoid charging unallowable costs to grants? Organizations can avoid unallowable charges by training staff on federal cost principles, implementing clear internal policies and account codes, carefully reviewing award terms and conditions, conducting regular internal audits, and consulting with their grants office when in doubt about the allowability of a cost.

Q5. What are the consequences of misclassifying costs in grant management? Misclassifying costs can lead to serious consequences, including the requirement to refund payments made for unallowable costs with interest. It may result in negative audit findings, damage to the organization’s credibility, and potentially jeopardize future funding opportunities. Proper cost classification is crucial for maintaining financial integrity and continued access to grant funding.